Scaling up requires better communication with your operations team.

By Daniel Beaird

As dental organizations scale and grow, practice owners move away from the dentist’s chair to learn marketing, accounting, operations, compliance, procurement skills and more. These can be daunting tasks for dentists and hiring a finance leader or team to run operations is critical to the mission.

“It’s a mindset and personal development journey,” said Emmet Scott, a partner at the Dental Entrepreneur Organization (DEO). “We see patients, or customers, as a revenue line item and employees as an expense line item. But, starting to see your employees as customers is part of that journey.”

The revenue line item of patient care doesn’t happen unless employees are being trained. “They’re actually your highest revenue-producing individuals. If you get rid of them, you’ll see your revenue decline,” Scott said.

For the operations side, some dental organizations want their finance leader to do it all.

“We say, I pay you a lot of money and you should be able to do all of this without systems, training and processes,” Scott said. “It’s our shortcut because we don’t want to develop people and accounting has given us an excuse for that.”

Asking your finance leader to do it all

When an associate general dentist is brought onboard, a schedule is typically already built out for them. But when operations teams are tasked with their jobs, dental organizations can be naive to marketing, finance and accounting roles. Collections, profit-and-loss (P&L) sheets, raising funds, bank relations and taxes can all be assigned to a team or an individual under one umbrella.

“We often get frustrated when our team isn’t executing well,” Scott said. “We’ll say things like, I thought you were the expert.’ But you can see why it’s not working if you think of all the things you’ve given them.”

It’s a lose-lose situation, because dental organizations need financial clarity, but they might be unaware of what they’re looking for. “If dentists thought about it from the clinical side, where they might need an orthodontist for specific procedures and an endodontist for other procedures, then it starts to make sense to them. They can organize that side accordingly. It’s the same on the financial side.”

Some best practices for working effectively with your finance team include:

- Meeting regularly

- Asking questions

- Setting clear expectations

- Having a shared vision

- Managing risk

Financial clarity

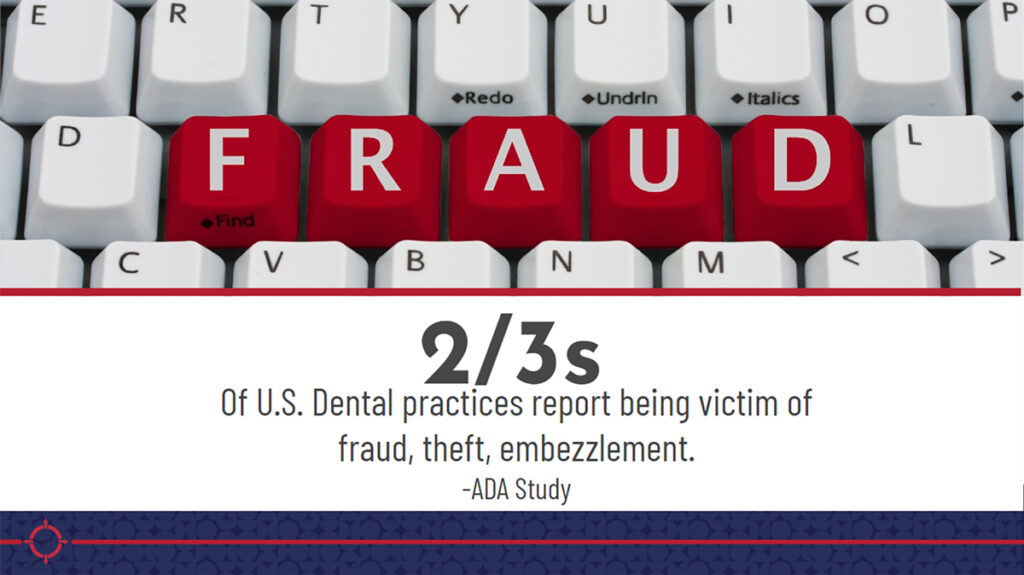

According to an ADA study, two-thirds of U.S. dental practices report being the victim of fraud, theft or embezzlement. Building out internal controls to help stem this problem is its own specialty. Practice management software might allow for a lack of internal controls, making it easier for individuals to start pocketing money.

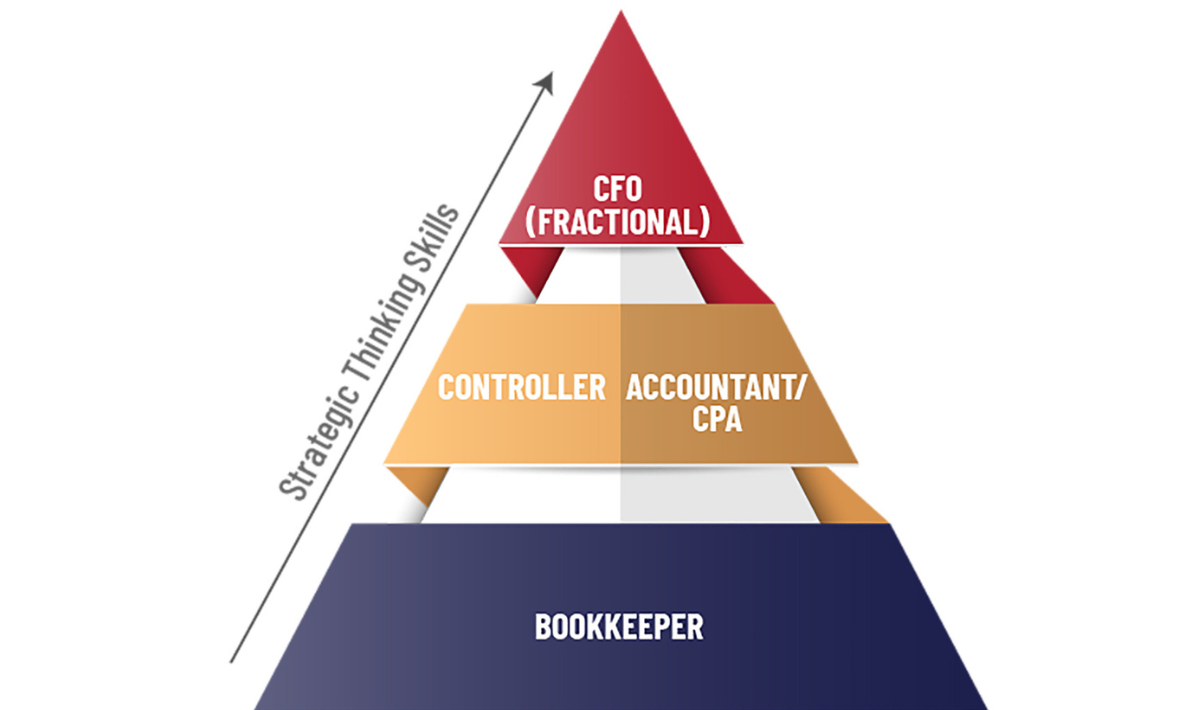

Many dental organizations have a bookkeeper and an accountant, while some also have a controller and a fractional or full-time CFO. These duties can be outsourced, handled in-house or both. As dental organizations grow to multiple locations, they need more financial clarity.

“Whether it’s three, five, 10, 20 or 50 locations, if you don’t have financial clarity, you’ll drive off a cliff,” Scott said.

Revenue covers up a lot of sins, but issues arise as soon as revenue declines and margins are squeezed. “As entrepreneurs, we’re so focused on grit and vision that sometimes we forget the basic blocking and tackling of business that we have to get right,” Scott said. “If there’s no profit, then there’s no mission.”

Chart of Accounts

A Chart of Accounts might be the most important aspect of bookkeeping. It’s the combination of all accounts used and listed in a financial report.

It lists all income, expense and equity accounts needed for business bookkeeping. All businesses use a Chart of Accounts in their accounting or bookkeeping to generate financial reports.

“A bookkeeper books the expense and revenue pieces, while a controller helps with internal controls and the Chart of Accounts,” Scott said. “Centralize this data and get the right people to help you figure out what you’re truly collecting.”

Types of finance leaders

Bookkeeper and Accountant

As dental organizations grow, practice managers or even family members might fill the role of bookkeeper, keeping up with the day-to-day financials and working with the revenue cycle management team in accounting software.

An accountant can handle preparing financial statements such as cash flow statements, tax preparation, audits and related tasks, manage payroll, track accounts payable and receivable, and apply for loans.

“Most accountants want to retain your organization to do your tax return,” Scott said. “They’ll say they provide bookkeeping services, but you have to know if they’ve built out a finance solution or if they’re stringing you along for your tax return.”

As more locations are added, dental organizations need to think about extra financial staffing.

“We had 200 bank accounts at 77 locations. As you scale and start DSOs, LLCs and partnerships, it can get intense,” Scott said.

Controller

For growing, multi-location DSOs, a controller might be the most important level of accounting. A good controller understands bookkeeping and the CFO’s role and keeps the DSO’s financial reporting on time.

“If you want somebody to run the team as you divide accounts payable from accounts receivable, the controller will run it,” Scott explained. “The controller will look at your internal controls to ensure what needs to be in place is there for scaling up.”

Think of this role as the lead assistant or the equivalent of a top-level hygienist on the clinical side, he says. As your business grows, scaling accounts receivable processes is crucial. Efficient business growth relies on improving cash flow, addressing communication issues, filling knowledge gaps and enhancing security.

“The controller should have a checklist of what needs to happen in order for financials to be timely and close out every month,” Scott said. “Ask them for the closing checklist. They should have checklists, schedules and a set of controls.”

Fractional or full-time CFO

Ensuring DSOs have market-ready financials for their partners, lenders and potential investors is critical to their success. Hiring a fractional or full-time CFO provides strategic financial expertise. This includes staff hirings, location expansions, access to capital, merger and acquisition services, and more.

“A CFO helps you answer questions like if I hire this individual, how will they perform, or if I buy this location, how will it perform,” Scott said. “A CFO also helps to understand valuations. So, start using this language to save yourself some headaches.”